A fresh prognosis for precious metals was just released. When it comes to the greatest value gold can achieve in 2020, there are many diverse viewpoints. However, many people believe that the overall value will be somewhat higher than it is now. Personally, I feel that this precious gold will outperform many experts’ estimates of $1,560 per ounce. This will occur as a result of central banks, which will have an influence, as well as certain geopolitical worries.

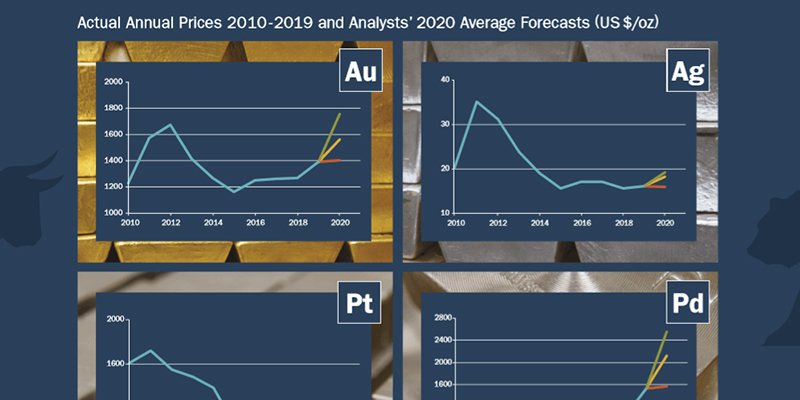

The LBMA prediction for 2020 contains gold, silver, platinum, and palladium statistics. It predicts that the prices of all precious metals will climb, although only slightly from the levels seen in January.

There will be a 12% increase in gold and silver, a 16% increase in platinum, and a 37% increase in palladium. Some analysts anticipate that the price of gold will fluctuate. One analyst predicts an average gold price of $1755, while another predicts $1398.

When all predictions are combined, the average value for the coming year appears to be $1550. This differs slightly from the current average price. Analysts are cautious and avoid making more modest projections. In the past, gold has often risen in value above the amount predicted by specialists. I anticipate it will be higher in 2020 than the $1550 recorded as an average in the

Analysts have cited geopolitical and economic tensions, U.S. monetary policy, forthcoming U.S. elections, and Brexit as factors for changes in gold prices.

This year, central banks will also play a vital role in preserving the precious metal’s rising value trend. The Fed will have to maintain its benchmark interest rate at a low level. This is also due to the fact that 2020 is a presidential election year. As always, the Fed would endeavour to seem non-partisan in this manner. As a result, we should expect the fed funds rate to stay steady this year. Because low interest rates lessen the possibility of competition from bonds and non-yielding bullion, gold prices will rise.

To assist the financial market, China’s central bank has implemented liquidity injection measures. As a result of the Covid-19 problem, the People’s Bank of China has stated that it will purchase 1.2 trillion yuan in short-term bonds. The Chinese government appears to be succeeding in preventing investor departure. In 2020, gold prices should benefit from accommodating monetary policy.

It is well known that central banks continue to buy gold. Its reserves are at an all-time high, surpassing anything seen in the past half-century.

With all of this in mind, it is feasible that the precious metal’s value will be higher than projected. The bull market will be kept in good condition by central bank monetary policy and gold purchases. Due of the uncertainty, investors will almost certainly elect to maintain their gold. Longer-term bullishness in gold is still warranted.